IFRS 17 – The biggest concerns for insurers

Pubished 19th January 2018

Effective from 1st January 2022, the new reporting standard, IFRS 17, published by the International Accounting Standards Board (“IASB”) is an update and replacement of the current IFRS 4 standard on insurance contracts.

Did you miss? We're hiring at ECOM! Careers at ECOM in Manchester, UK

In summary, the new standard involves stronger demands for transparency, security, clarity of communications and trust. As organisations decipher what IFRS 17 means for them, we have gathered the top concerns for insurers embarking on this journey.

People, training and resources

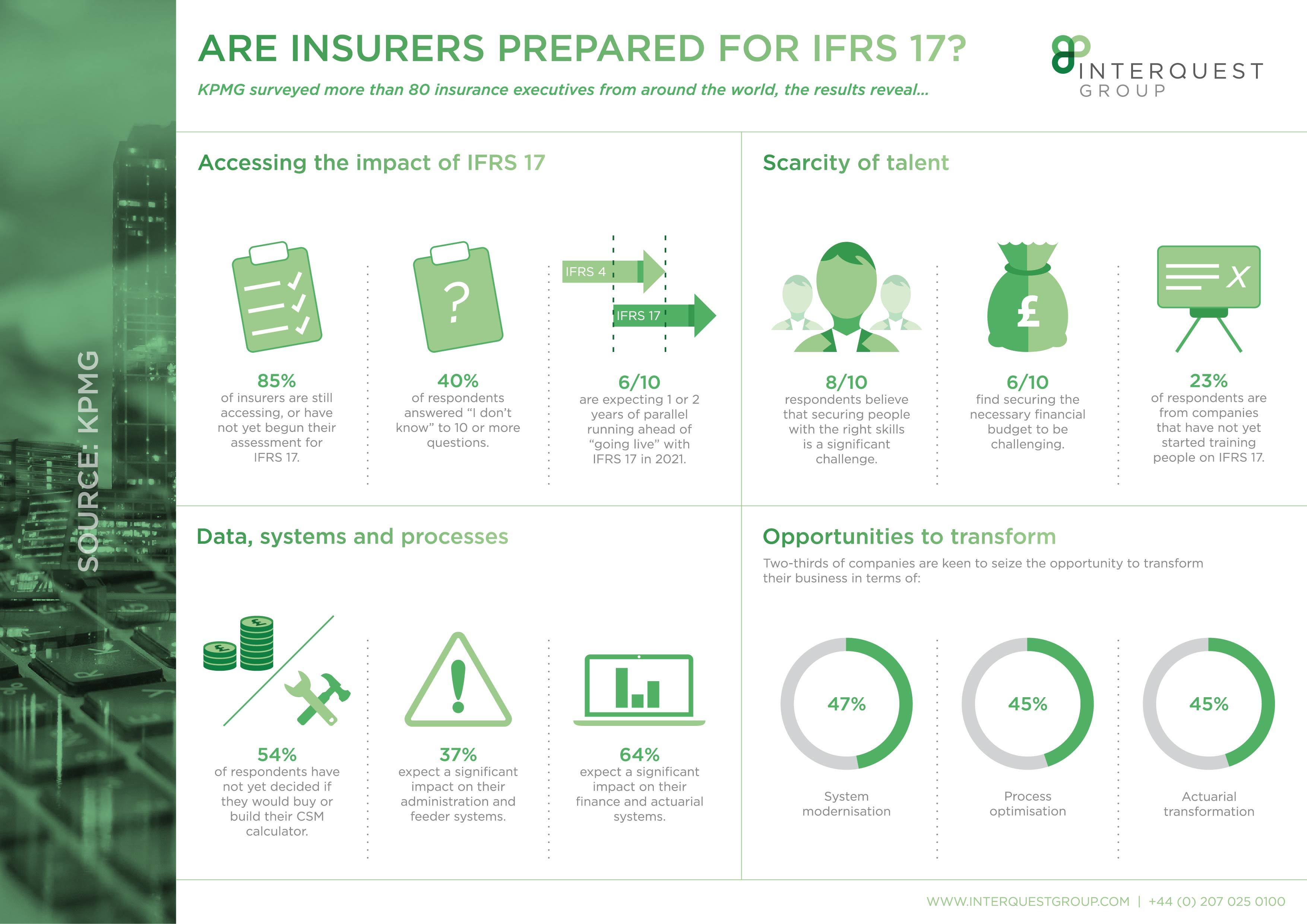

Training and education on IFRS 17 will need to be carried out throughout the business, in a similar fashion to IFRS 9. Recently more than 80 insurance executives took part in a survey by KPMG revealing 8 out of 10 respondents believe that securing people with the right skills is a significant challenge.

However instead of focussing on training key staff, in order to ensure compliance, all layers of the organisation will need to be trained on the new reporting standard. A cultural change may happen in order for the workforce to understand the language and explain the business results.

Early adopters may be able to acquire the best talent in an already scarce market, late starters could find themselves in a double jeopardy – more ground to make up and a smaller talent pool available from which to deliver it.

Assessing the impact

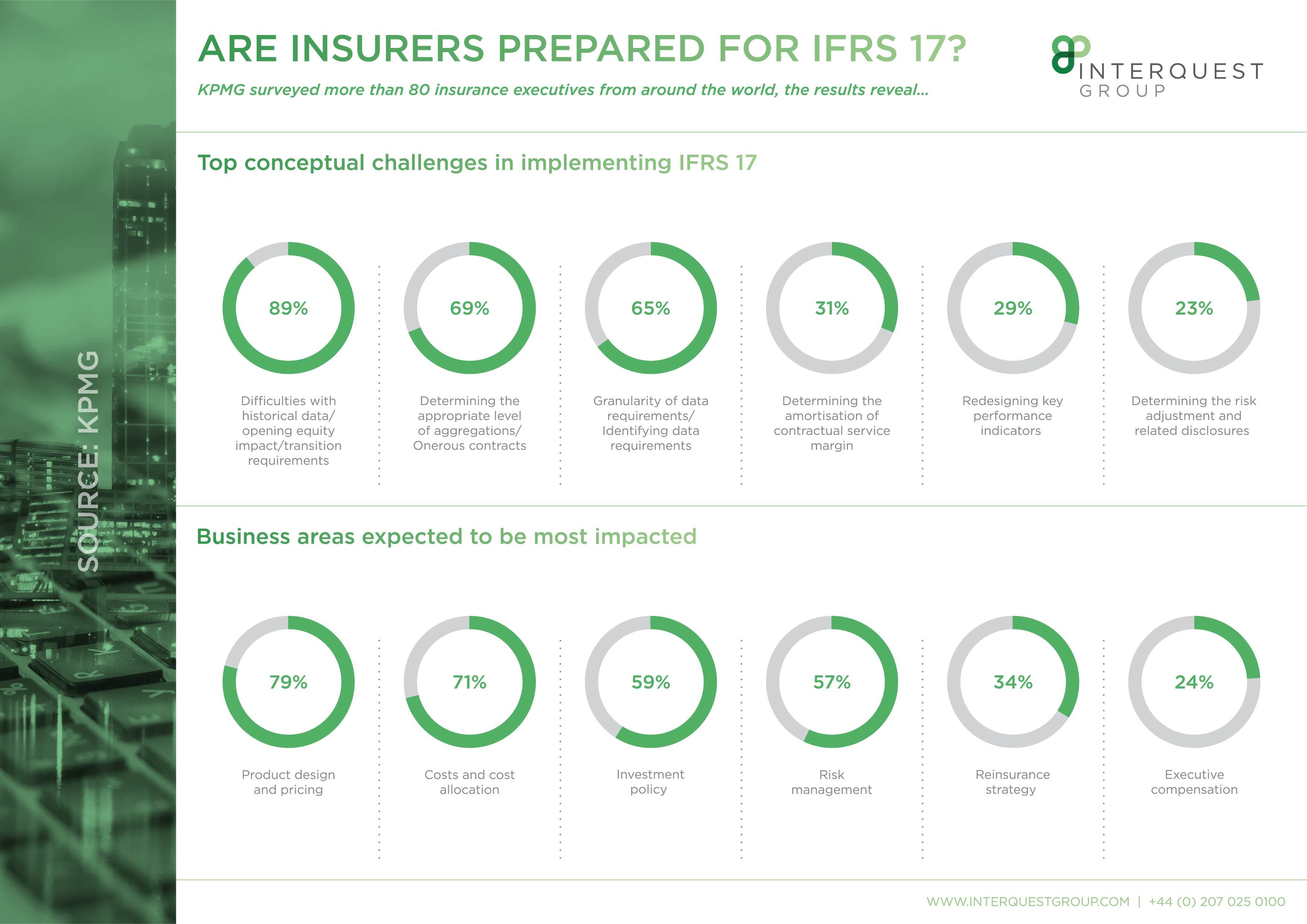

In KPMG’s survey 40% of respondents answered “I don’t know” to 10 or more questions portraying the extent of uncertainty is significant. An important action is to create an impact assessment identifying the working assumptions that are going to have the biggest impact on design and development of IT systems.

One of the most challenging tasks insurers have is to implement operationalising Contractual Service Margin (CSM) for the first time. This is an important decision although 6 out of 10 respondents have not yet decided whether to build their own CSM calculator.

Large insurance companies could find the transition more difficult than their smaller counterparts who are found to be more geared towards compliance. Two-thirds of organisations are keen to transform their business in terms of systems modernisation (47%), process optimisation (45%) and actuarial transformation (45%).

Focusing on the second order effects that will have the biggest impact on steering the business, including transition.

Building a Roadmap

Every insurance firm is different and should approach IFRS 17 strategically using a clear roadmap to achieve greater efficiency. Once assessments have been analysed, the areas with the biggest impact on steering the business should be focussed upon. Assumptions such as discount rate and risk adjustment can be fine-tuned in the run up to going live.

Time is of the essence

Think of it this way, not taking action now could develop risks which slow the implementation of IFRS 17 including less runway for systems integration and a shrinking talent pool to action changes. Much needs to be achieved in three years therefore the time for action is now.

Adam Jones, Consultant, InterQuest Risk Practice commented:

“IFRS 17 is likely to prove the most disruptive change to the Insurance/Accounting industry across Europe over the coming years. With Solvency II programmes progressing to a business as usual state, insurers must now turn their attention to developing project teams to specifically address the IFRS 17 regulations. The initial impact assessments are likely nearing completion, if not already completed. Any delays in the process could incur significant costs and compliance issues. Early movers are likely to see significant benefits as they are able to secure the best talent in the market to allow them to deliver on time and on budget.”

The InterQuest Group is a specialist staffing organisation offering interim, permanent, and search solutions. Our risk practice has a strong track record in delivering the best talent to allow our clients to succeed.